On things #1 - On NFT Incomprehension, Crossing the Chasm

NFT’s are a “thing” now. At least for a growing group of believers. With daily sales of these assets approaching the $100 million mark and Beeple making headlines with his $69 million digital collage sale, interest for this new type of digital assets is spreading like an epidemic. However, they have not gone down well for all people.

On NFTs

Non-fungible tokens, NFTs for short, are “proofs of ownership in the blockchain”. Their most popular form right now is in the form of digital art (visit Opensea to see some of examples) but use cases from real estate to medical records and IP. Remember, blockchains are immutable ledgers. Keeping a record of ownership in them is just a way to secure authenticity. The same way you can verify transactions, smart contracts allow for the verification of ownerhip in networks like Ethereum and Solana. For more on NFT’s, you can check out this post on the Ethereum blog.

The rise… to where?

It comes without question that NFT adoption is growing, specially in developing countries. A Finder report on 2021 NFT statistics showed that current ownerhip of NFTs as a percentage of total population averaged 11.6% in surveyed countries, with a 20.9% projection expected for following years. Although the US lags behind with only 3 in every 10 owning a digital asset, catalysts like Facebook’s name change to Meta, augur a great future in the years to come. NFTs are on the road to mass adoption.

Having said that, it is not being an easy path. The growing number of adopters has been matched by an also rising number of “haters” that believe NFTs are a scam built to take money away from the newcomers with hopes on profiting on this new gold rush. And they are right, mostly. Pricing a hyped asset that promises infinite use cases is complicated. When Internet first started becoming useful for the average citizen, anything related to it was thought to be the future. In this battle it was internet bulls that ended up being right, but detractors were not completely wrong. Of the companies that were around, very few survived and those that did, took a bit hit i.e it took Amazon to reach its dotcom ATH.

Internet WAS the new next thing, but success does not happen overnight.

Early-adopters vs general public

Whether Snoop Dogg, Jimmy Fallon, Eminem (to mention a few) are right about NFTs or not, I fear the current battle between digital asset optimists and pesimists is very similar to the internet craze of the late 90s.

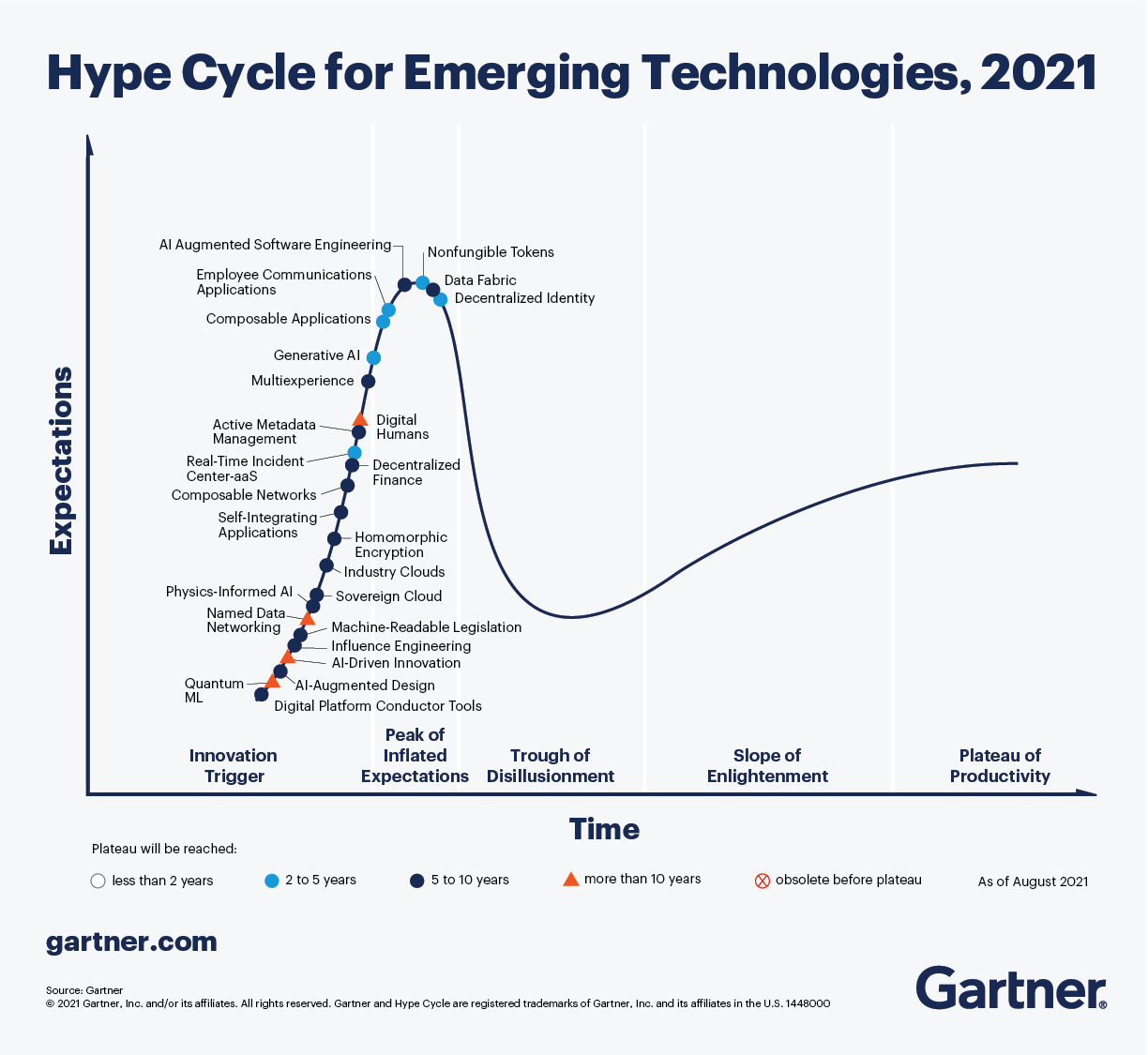

These types of battles are not rare in new technologies: early-adopters that are quicker to understand the value proposition (and some opportunists looking to make quick money) face the skepticism of the general public, reluctant to “cross the chasm”. To represent this confrontation, it is useful to be familiar with the Gartner Hype Cycle and the Technology Adoption Curve. A combination of the two perfectly depicts my view on NFTs.

Hype Cycle vs Tech Adoption

The Gartner Hype Cycle is a tool used to map hype for a product against time. Introduction of the product/technology is followed by a growth in expectations, as speculations for its possible use cases reach bizarre extremes (world domination, for the most radical believers). However, humans are impatient beings, and delays in reaching this sometimes a bit high expectations make people lose interest on the product, leaving only the rational and the crazy routing for technology’s success. Eventually, the curve flattens as realistic use cases start to see adoption (or product/technology falls into oblivion).

The Technology Adoption Curve maps the number of new users from launch. The relation is built in quite a logical manner: marketing for a product is most complicated in the early stages, reaches its most efficient stage when organic growth is at its highest (new users come refered by other users) and some “laggards” resist when product penetration is at its highest. Basics aside, the most important concept to understand here is what many marketers call the “chasm”, which is the step you have to take from going from your early-adopter community to the average consumer (Geoffrey Moore’s Crossing the Chasm talks about this in depth).

Consulting firm Gartner places NFTs on peak hype right now, claiming they could be 5 years away from reaching mass adoption, a much more advanced scenario than the one faced by DeFi, for example, that is still lagginf in the Innovation Trigger phase.

Hype Cycle for 2021 emergent technologies

My view on the current adoption of NFTs is that there is a disconnect between innovators and the early majority when it comes to hype, signaling the product has not quite crossed the chasm. On the one hand we have newcomers excited about their new discovery, and on the other, a confused majority that is alien to their excitement and, in most cases correctly, call them a scam and warn about a “NFT bubble”. Both try to be on the winning side of the argument, and whether you argue that NFTs are worthless or, on the opposite, believe they are the future of ownerhip, the truth is you will probably be right. Unfortunate as it may be, it is not black or white when it comes to the future of these tokens.

Ignorance

As I see it, it is true that 90% of projects will become worthless, leaving thousands if not millions bagholding. And maybe 90% is a conservative guess. Most P2E games introduce NFTsjust for the sake of doing so, with litte to no need for them, metaverse land investors are bidding exorbitant amounts trying to anticipate rising prices in what may be too much anticipation and some average buyers are tricked into buying digital art from artists that only may be the next Beeple.

However, a bad use of the technology does not correlate with a bad technology. Use cases for NFTs are not imaginary. I, for example, predict a great future in real estate and digital art. In many cases, detractors cherry pick

Closing remarks

My view on the current adoption of NFTs is that there is a disconnect between innovators and the early majority when it comes to hype, signaling the product has not quite crossed the chasm. On the one hand we have newcomers excited Both try to be on the winning side of the argument, and whether you argue that NFTs are worthless or, on the opposite, believe they are the future of ownerhip, the truth is you will probably be right. Unfortunate as it may be, it is not black or white when it comes to the future of these tokens.

It has happened with the internet, e-commerce, machine learning and AI, wearable tech, blockhain (2017 + blockhain in your startup name = million dollar funding series), delivery, real estate i-buyers etc. and is happening with EVs. It could also be happening with NFTs. Only time will tell.

My recommendation for enthusiasts is to try and be pessimistic for a day to try and find any flaws in the current state of the market. If you can’t find any, then maybe you’re too naive. The same goes for those who criticize them with little to no understanding about how the WHOLE ecosystem works. Try read a book, a news article or even a Twitter thread. Worst thing that can happen is you learn something. If you keep crying wolf, nobody will believe you when the wolf really comes, and an I told you, on either side, is of little to no help.

If you want to confront me on anything mentioned in this article, I will be glad to answer in info.desotto@gmail.com. No spam please! 😃

[1] JPG File Sells for $69 Million, as ‘NFT Mania’ Gathers Pace New York Times. 🔗

[2] Non-fungible tokens (NFT) Ethereum Foundation. 🔗

[3] NFT statistics 2021 Finder . 🔗

[4] Gartner Hype Cycle Gartner. 🔗

[5] Crossing the Chasm Geoffrey Moore. 📖 | 🔗

[6] 3 Themes Surface in the 2021 Hype Cycle for Emerging Technologies Gartner. 🔗

If you enjoyed this post, please subscribe to be notified whenever a new one comes out. Have a nice day!